iServe Residential Lending | Mortgage Blog

- Details

- Written by Ken

Sometimes we like to mix up our blogs on here.

We know some of our clients have just moved into new neighborhoods or have had children in the last few years.

Halloween can be a new experience in both of these circumstances!

Enjoy these Halloween Safety Tips

" alt="" />

" alt="" />

- Details

- Written by Ken

We will want to verify certain information about you and the property. Borrower information will include verification of income and employment, assets, and your credit history. You, the applicant, as part of your application process, will usually provide some of this information. Other information, such as your credit history, will be obtained directly from the credit bureaus.

For the property itself, we will order an appraisal in most cases and a legal description of the property, such as a title report. We have "approved appraisal company" lists, so if you have an old appraisal, we may be able to accept it.

The Loan Approval Process

During the "processing" and/or "underwriting" period, your credit, assets, income and other determinants are checked and compiled. Your loan is either approved with conditions, or approved without conditions or declined. Conditions are further documentation or checks we will need to finalize your loan before funds can be dispersed. Some borrowers become frustrated by conditions that surface at the end of a loan transaction and can't understand why they are being raised so late. Final conditions are sometimes added for final approval. We do our best to help you through the process - remember, we are simply trying to meet conditions imposed by other sources.

Since most loans are sold and serviced by other parties, the lender must verify that the loan can be sold upon close. Not to worry, no other terms of your loan can be changed after you have signed your final loan documents. When all conditions are met, your loan documents are drawn up and forwarded to the place of settlement or closing, typically a title and/or escrow company.

IMPORTANT NOTE:

Do not make any adverse changes to your financial "picture" during the loan process. Things as simple as applying for a new department store credit card to purchase a new appliance will at least force an explanation to be given and at worst may cause your loan not to fund and the approval to be withdrawn. Many times a final credit report update and additional calls to your employer may be required before funding the loan. Be patient and your loan will flow smoothly.

- Details

- Written by Ken

Refinancing Your Home?

Whether you want to refinance your primary residence, second home or investment property, our expert advisors can help you lower your interest rate and payment.

Why should you refinance?

With mortgage rates at historic lows, you should seriously consider reevaluationg your mortgage. If you have had a mortgage for several years you may have the opportunity to lower your rate and thus your monthly mortgage payment. Saving money each month means you can pay off other debts, save towards your childs's education, or take that vacation you always wanted.

How can you refinance?

Cash-Out Refinance: Need some extra cash to make some home improvements or pay your child’s college tuition? Cash-out refinancing is a great option for homeowner’s who have built a significant amount of equity into their home over the years.

FHA Streamline: An FHA streamline mortgage is a fast and easy way to save money on your FHA mortgage. Depending on the terms of your current mortgage, you may be eligible to refinance with a minimum 5% reduction in your payment, with no appraisal, income or asset verification required.

VA Interest Rate Reduction Refinance Loan (IRRL): If you are an activie duty military personnel or a Veterans, this refinance option can help you obtain a lower interest rate and monthly payment by refinancing your existing VA loans.

Harp 2.0 Program: The government's HARP 2.0 program may allow you to refinance into a more affordable mortgage, even if your house is not worth what it was when you purchased it.

Refinance to a Fixed-Rate Mortgage: Rates can go up and down. If rates go up and you have an adjustable-rate mortgage, you'll be paying more every month. By refinancing to a fixed-rate mortgage, you can lock in a rate over the life of the loan and will pay the same amount each month.

Article From: https://iservelending.com/pages/refinance

- Details

- Written by Ken

Many people contact us on a weekly basis looking to break free from the lease and get in on buying! Especially here in the Middle Tennessee area. We found an article from Crye-Leike Real Estate Services that we thought would be beneficial to our clients when they are trying to decide on the next move for their family.

What are the benefits of renting versus buying?

The decision to continue renting or to buy can be a confusing one. Some people continue renting because of the perceived flexibility of moving almost as soon as you decide. Although moving before a lease is up can cost you money, some continue renting because they don't enjoy yard work and don't want the responsibility that goes with home ownership.

Here are some things to consider when choosing between renting and buying:

- Do you want to spend several years in a house and in a neighborhood?

- Do you enjoy lawn and garden work?

- Do you need flexibility to move suddenly to care for family or other reasons?

- Do you want to keep your assets accessible in the bank, or do you want to invest long-term in a home?

- Is personalizing your surroundings through paint or other cosmetic changes important to you?

Maybe the strongest reason for buying a home is the financial security you build as you pay your mortgage. There are short term and long-term tax advantages to homeownership. The mortgage interest and real estate taxes are tax deductible, which allows you to subtract part of your housing-related expenses from your taxable income, which could reduce your tax bill.

Other reasons to buy a home:

- It's a good investment. Investors say overwhelmingly that real estate can typically be a safer and better investment than stocks and bonds!

- Tax savings. Mortgage interest and property taxes are tax-deductible, making tax savings one of the biggest benefits of homeownership. This means that you could possibly pay less tax or you get a bigger tax return.

- Improvements add value. Unlike rental improvements, when you paint, make additions, or improvements to your home it increases in value.

- Buying builds equity. Buying a home is good use of your money. As you make payments over time, the equity increases. When renting, you get no return for your money. Once the money is spent, it's gone.

- Low interest rates. While interest rates are slowly going up, the nation is still experiencing record low rates which allows buyers to buy more house for their money at lower monthly payments.

- Capital appreciation. Unlike buying a car, or renting... homes (when taken care of) usually appreciate in value.

- More Space. If you've always wanted that extra room for an office or weight room...here's your chance. Renters typically live in smaller spaces...home buyers have more square footage for their money.

- The "owned" home is your castle. You control the decor. You can paint and decorate as you like. You can add to the size of your home and make improvements. You will not have to face rent increases.

"Renting vs. Buying." Renting v. Buying. Crye Leike Real Estate Sevices, 2015. Web. 22 June 2015. <http://www.crye-leike.com/buyerseller/buyer_rent_v_buy.php>.

- Details

- Written by Ken

AWESOME!

You have decided that it is now time to purchase your FIRST home. There is nothing more rewarding than someone handing you the keys to YOUR house. You’re probably wondering where to start, who to contact, and what you need to do! No worries,the Shelbyville Mortgage Team can help lead you to home ownership in Shelbyville and the surrounding areas all you have to do is get pre qualified.

How do I get Pre-Qualified?

EASY! Do you have 10-15 minutes to spare online or even on the phone? IF yes, CLICK HERE and fill out the QUICK pre qualification form. If you prefer to speak to someone, give us a call at (615)-869-0396 and he can walk you through the application process.

What Information is needed for the Application?

Great Question! You will need to know basic information such as

- Name

- current address

- birthday

- social security number

- previous address

- Co Borrowers information (this would be a spouse or whoever else will be on the loan as well)

- Current and Past Employment History

- Assets (Bank & Real Estate) if you currently have any

- Your current Expenses and Income

These are all things you can also make an estimate on if you do now know exacts. We can work through the details later. Here is exactly what the application tool bar will look like in our system.

Okay, So I’m Pre Qualified now what?

IT’S time to SHOP! When you’re pre qualified, you are letting your realtor know that you are READY. They also have an idea of what houses to show you that are in your price range. Nothing is more disheartening than walking into a $600,000 home and being qualified for $350,000. That’ why being pre qualified and knowing your budget is SO important. Plus, with the market being extremely HOT in Shelbyville, when you find your dream home, you will want to make an offer and FAST. Why wait?

My Loan Originator just told me I don’t qualify quite yet…What can I do?

Again, this is why we want our borrowers to fill out the application. Just because you didn’t qualify today doesn’t mean that you won’t 6 months from now. Our Loan Originators genuinely care for their clients. They will go over exactly WHY you didn’t qualify and work with you UNTIL YOU DO QUALIFY! Credit is easy to fix when you know exactly where you need to fix it and how! That’s why we are here.

We can’t wait to begin this journey to homeownership with you! We will work with you every step of the way! See you at the Closing Table!

Shelbyville Mortgage Team

- Details

- Written by iServe Team

Will current mortgage rates continue to fall?

One week after making its biggest one-week improvement in more than a year, the average conventional 30-year fixed mortgage rate has moved below 4 percent for the first time in 2014.

The 30-year mortgage rate now averages 3.97% nationwide/ For renters and active home buyers, this month’s drop in rates is helping to keep U.S. homes more affordable at a time during which home values continue to climb. And, for existing homeowners, mortgage rates in the 3s make it easier to refinance into lower monthly payments. There are more than 5 million homeowners currently “in the money” to refinance to lower rates. If you think you may be among them, take a look at today’s mortgage rates while they’re still low.

- Details

- Written by Prentiss Holt

Homeowners who want to increase the appeal of their residence before putting it up for sale can, within a few hours and with a little elbow grease, perform some do-it-yourself (DIY) kitchen upgrades that are sure to pique the interest of would-be buyers.

Many people either have or are in the process of listing their home, so it makes sense to do as much as possible to attract the interest of prospective purchasers.

It need not cost a proverbial arm and a leg to boost the selling price of a home. Here are three DIY kitchen upgrades that will help homeowners gain a competitive advantage in the real estate market and get attractive offers for their residence.

- Details

- Written by Prentiss Holt

The FHA mortgage program has become a very popular mortgage program with first time homebuyers. Home buyers do have many options with mortgage programs when looking to get pre-approved, but the FHA program has become the most popular.

There are many reasons why the FHA program has become very popular among first time home buyers. Here are some of the great benefits why the FHA mortgage program is great for home buyers.

Credit Score

The minimum credit score allowed with most lenders is a middle score of 640. It’s very common that home buyers don’t realize they have a good enough credit score to qualify for the FHA mortgage program. The lower credit score that is allowed opens up the opportunity for many first time home buyers to qualify for a mortgage.

- Details

- Written by Prentiss Holt

- Details

- Written by Prentiss Holt

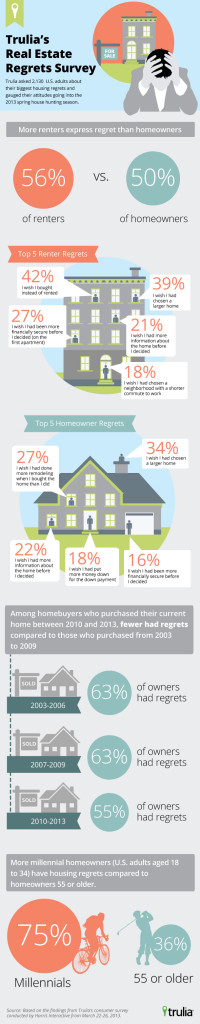

Many of you have heard me talking positively about keeping a positive attitude, (knowing that it will determine your aptitude).Attached below is a survey of both renters and homeowners, & some of the regrets they have.

- Details

- Written by Prentiss Holt

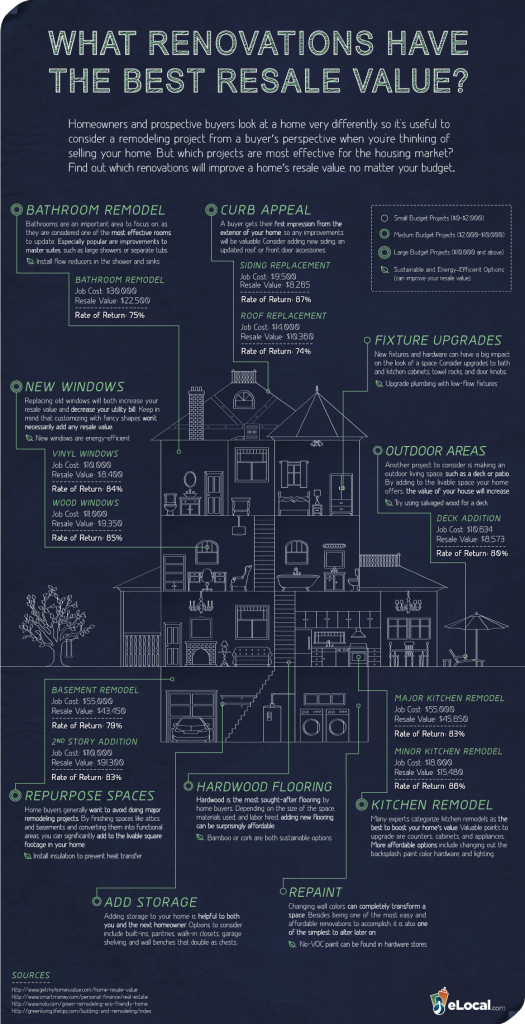

THREG has been working a lot on our positive attitudes and focusing on subjective things that make us a top tier real estate team. Sometimes it’s nice to concentrate on more factual objective things, rather than the market negativity.

This graphic has some good information about home renovations and their resale values.

How do these differ or compare to trends in your area?

- Details

- Written by Prentiss Holt

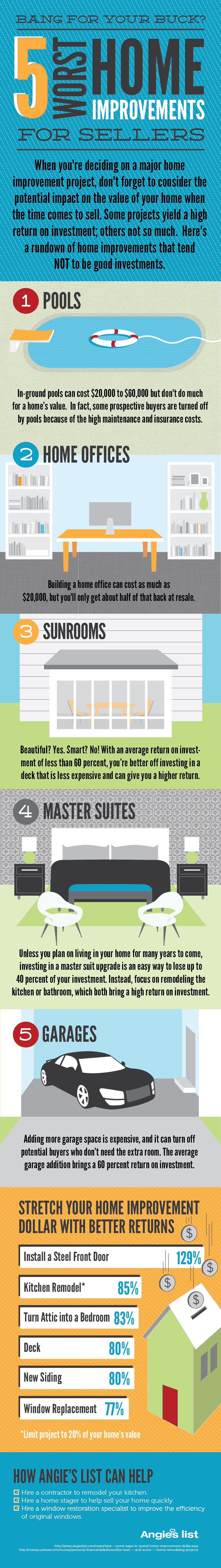

Clients will always ask you and your Realtor whats the best home improvement and renovation they could possibly do to yield the most out of their home. It’s natural to want to personalize your investment and generate the most bang for the buck & lets face it, its also fun!

But many people don’t realize that they’ll actually lose money on the items or changes that rarely see an increase in value to the property and the consumer. Here are some tips your customers may benefit from.

- Details

- Written by Dennis Phillips

A mortgage is a big deal. The bank risks a lot of money, and they have been increasingly cautious since the subprime mortgage debacle. To qualify for a mortgage, good credit is essential.

- Details

- Written by Dennis Phillips

Credit scores indicate to lenders how well you manage money. You can improve bad credit by demonstrating that you can now handle money more responsibly. Furthermore, since poor credit scores translate into high interest rates on home loans, an improved score will help you get lower interest rates when you are ready to qualify.

FHA loans are loans the FHA insures against default, meaning that lenders are offered a guarantee that if the borrower fails to make loan payments, the debt will be covered by the FHA. Consequently, lenders are far more willing to extend mortgage loans even to people with low credit scores. Furthermore, FHA loans allow you to purchase a home with a down payment as low as 3.5 percent.

- Details

- Written by Dennis Phillips

A mortgage is a big deal. The bank risks a lot of money, and they have been increasingly cautious since the subprime mortgage debacle. To qualify for a mortgage, good credit is essential.

- Details

- Written by Rick Trew

- Details

- Written by iServe Team

Driven by rising home prices and growing demand, the U.S. housing recovery is well underway, So said The State of the Nation’s Housing report released by the Joint Center for Housing Studies of Harvard University. While still at historically low levels, housing construction has finally turned the corner. But millions of homeowners are still delinquent on their mortgages or owe more than their homes are worth, and severe housing cost burdens have set a new record.

Driven by an increase of 1.1 million renter households, last year marked the second consecutive year of double- digit percentage increases in multifamily construction. But the flip side of the strong rental market was the continued slide in homeownership rates. Even as historically low interest rates have helped make the monthly cost of owning a home more favorable than any time in the past 40 years, the national homeownership rate fell for the eighth straight year in 2012.

- Details

- Written by iServe Team

The recent spike in mortgage rates has caused a frenzy of speculation about how the housing recovery may be negatively impacted. Doomsayers abound, with some rushing to declare the housing recovery over.

It is true that mortgage rates rose almost a full point between late May and early July, but they are still far, far lower than they have been for years. While rates have recently nudged out of the 3 percent range and into the 4s, you would still have to go back almost 50 years to find rates that low. A 4 percent or even 5 percent interest rate is still nothing short of phenomenal. Americans can borrow money far cheaper than the nation of Australia can.